Search -

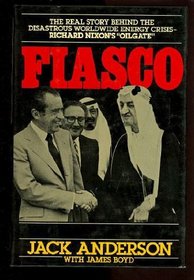

Fiasco

Fiasco

Author:

"A world-upending revolution, wholly triumphant because wholly unopposed and wholly acquiesced in, had placed in the hands of surprised OpEC regimes the power to reduce oil output below normal demand, which quickly became power to raise prices to whatever level the panicked bidding of a leaderless, oil-dependent West would bear." — The syndicated... more »

Author:

"A world-upending revolution, wholly triumphant because wholly unopposed and wholly acquiesced in, had placed in the hands of surprised OpEC regimes the power to reduce oil output below normal demand, which quickly became power to raise prices to whatever level the panicked bidding of a leaderless, oil-dependent West would bear." — The syndicated... more »

ISBN-13: 9780812909432

ISBN-10: 0812909437

Publication Date: 10/1983

Pages: 386

Rating: 2

ISBN-10: 0812909437

Publication Date: 10/1983

Pages: 386

Rating: 2

4 stars, based on 2 ratings

Genres: