Search -

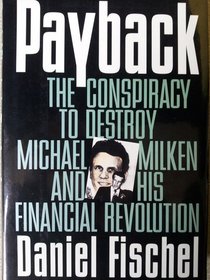

Payback: The Conspiracy to Destroy Michael Milken and His Financial Revolution

Payback The Conspiracy to Destroy Michael Milken and His Financial Revolution

Author:

To this day in the popular mind, Michael Milken is the poster boy of the "Decade of Greed" -- the inspiration for movie character Gordon Gekko's chilling assertion that "Greed is good." Conventional wisdom driven by media hype deplored the corporate raiders and takeover arbitrageurs of the 1980s. But as Daniel Fischel, CE... more »

Author:

To this day in the popular mind, Michael Milken is the poster boy of the "Decade of Greed" -- the inspiration for movie character Gordon Gekko's chilling assertion that "Greed is good." Conventional wisdom driven by media hype deplored the corporate raiders and takeover arbitrageurs of the 1980s. But as Daniel Fischel, CE... more »

ISBN-13: 9780887307577

ISBN-10: 0887307574

Publication Date: 7/1995

Pages: 332

Rating: ?

ISBN-10: 0887307574

Publication Date: 7/1995

Pages: 332

Rating: ?

0 stars, based on 0 rating

Publisher: HarperCollins Publishers

Book Type: Hardcover

Other Versions: Paperback

Members Wishing: 0

Reviews: Amazon | Write a Review

Book Type: Hardcover

Other Versions: Paperback

Members Wishing: 0

Reviews: Amazon | Write a Review

Genres:

- Biographies & Memoirs >> True Crime >> True Crime

- Business & Money >> Biography & History >> Company Histories

- Business & Money >> General

- Nonfiction >> Current Events >> Conspiracy Theories